"The one and only Insurance Program for Indonesian Crew Fishers who has been appointed and collaborates with INFISA to provide the best protection for them in accordance with regulations is Allianz Life Indonesia"

"According to the regulations set by INFISA, every Indonesian Crew Fishers who departs on duty, is a must to have specific Insurance Program from Allianz Life Indonesia"

The Importance of Insurance in Manning Agent Industries

1. The high risk associated with jobs on board ships

2. As a professional & responsible company, it is essential to provide the best protection for human resources as a guarantee & benefit for the personnel, their families, and especially for the ship’s owners who employ them

3. This program is specifically designed for seafaring personnel working on fishing or commercial vessels, both domestically and internationally (covering ships flying the flags of Indonesia and International flags)

4. This program is not for the general public but is specifically tailored for high risk occupations

5. Regulators acknowledge that the market requires precise solutions, especially when faced with issues in the field. This is why Allianz Indonesia has introduced a specialized program for seafarers (both Domestic and International). Through this approach, we not only identify the problems but also provide effective solutions

ALLIANZ

Allianz Life Indonesia

Allianz was born in Berlin, German 133 years ago. Is the largest insurance and financial services company in the world. Companies with healthy and strong fund management.

For example, this is one of the assets of Allianz in the world. And Allianz become a big sponsors for a lot of popular events, such as F1 Grand Prix

Big companies such as BMW and Mercedez Benz entrust their funds to Allianz. In 2022, Allianz's total assets are EUR 14.2 billion.

The number of customers is widespread all over the world.

In 1906, natural disaster occurred in San Francisco, 3,000 customers died, and Allianz paid all claims of USD 350 million.

Allianz is the insurance company with the largest total assets in the world.

According to Interbrand, Allianz is ranked 34th most valuable company in the World. As yo can see, there is no other Insurance

Company on the top list, that Allianz is the 1st one

Nowadays in Indonesia, Allianz already 42 years old. Allianz branch offices are spread in every region of Indonesia, ready to serve all customers. Allianz gave evidence, not a promise. In 2021, Allianz paid a claim of IDR 37 Billion per day.

7 years in a row Allianz has become the most recommended insurance brand by its customers. Allianz is the only winner of the Indonesia Insurance Industry Leader 2023 award in the Health Insurance category.

PRODUCT

The purchase of policies (including benefits) is all in the form of Rupiah currency (IDR), because the one who issued this product is Allianz Life Indonesia.

Death Benefit

1. The Beneficiary must notify the claim in writing and submit the documents specified in the Policy to Allianz, not later than 60 calendar days from the date of the Insured's death. The Beneficiary is required to provide a fully completed and accurate claim form, signed, along with supporting documents as stipulated in the claim form and the Policy to Allianz.

2. The submission of claims for Death Benefits or Death and Total Permanent Disability Benefits (in the event of the Insured's death due to an Accident) must be accompanied by the following documents:

a. (i) Original Policy and original Policy Data; or (ii) Original Policy Data (for those who opt for electronic/digital Policies).

b. The claim form for death benefits must be completed accurately by the Beneficiary.

c. The claim form for death benefits must be completed accurately by the attending Doctor/Physician who provided treatment for the Insured.

d. The power of attorney release form for medical information and data, filled out and signed on a stamped paper by the Beneficiary.

e. Photocopy of the Death Certificate issued by the relevant Government Authority (Death Certificate Extract).

f. Photocopy of a Statement from the Police regarding the unusual, unknown, or accidental cause of the Insured's death, along with the autopsy or medical examination results from a Doctor.

g. A statement letter providing a comprehensive and accurate chronology of the Insured's death, prepared and signed by the Beneficiary (if the Insured passed away at home without medical care).

h. Photocopies of all medical examination results related to medical procedures, treatments, and/or healthcare services undergone and/or received by the Insured throughout their lifetime.

i. The completed and accurate notification form for the bank account number by the Beneficiary, along with a photocopy of the Beneficiary's bank passbook.

j. Photocopy of the Insured's identification (such as Birth Certificate for children, Electronic Identification Card (KTP) for Indonesian citizens (adults), and Passport for foreign citizens (adults)).

k. Photocopy of the Beneficiary's identification (such as Birth Certificate for children, Electronic Identification Card (KTP) for Indonesian citizens (adults), and Passport for foreign citizens (adults)).

l. Photocopy of supporting documents explaining the relationship between the Insured and the Beneficiary.

m. Other documents (if required).

*Terms and conditions apply as per the Policy.

We are not obligated to pay the Death Benefit (as defined in the Policy), but we only pay the Investment Value (if any), in the event of the Insured's death caused directly or indirectly by the following events:

1. Within the first year from the Policy Commencement Date or the date of the last Policy reinstatement, if the Insured dies by suicide.

2. The Insured's death during the Insurance Period due to being sentenced to death by a court, or intentionally committing or participating in a criminal act or an attempt of a criminal act, whether active or passive, or if the Insured dies as a result of an insurance crime committed by a party with an interest in this Coverage.

We are not obligated to pay Death and Disability Benefits Due to Accidents if the Insured dies or suffers from Permanent Disability caused directly or indirectly by the following events:

1. Involvement in organized fighting, unless it is an act of self-defense.

2. Inflicting harm upon oneself, suicide, or attempted suicide, whether in a state of physical and mental well-being or not, or

3. Criminal acts or attempted criminal acts or legal violations or attempted legal violations committed by the Insured or resistance undertaken by the Insured at the time of arrest of any person (including the Insured) conducted by the authorities, or

4. Criminal actions committed with specific intent by the Policyholder, Insured, or someone designated as the Beneficiary, or

5. The Insured participates in a flight other than as an official passenger or crew member of a scheduled, regular, and licensed commercial airline, or

6. Occupation or profession involving risk on the part of the Insured, such as in the military, police, firefighting, mining, or other high-risk occupations/professions, or

7. Sports or hobbies of the Insured that involve danger, such as car racing, motorcycle racing, horse racing, hang gliding, mountain climbing, boxing, wrestling, including other sports or hobbies that also entail danger and risk, or

8. Accidents resulting from mental illness, diseases affecting the nervous system, intoxication (the Insured is under the influence of alcohol), the use of narcotics, and/or illegal drugs.

Total Permanent Disability (TPD)

1. Loss of Basic Function.

2. Two eyes / Two hands / Two legs.

3. Or a combination of two functions:.

- One hand & One Leg

- One hand & One eye

- One eye & One leg

| Age of Entry | 6 - 69 years old |

| Currency | Rupiah IDR |

| Protection Period Options - Age | 45 years - 50 years - 55 years - 60 years - 65 years - 70 years |

| Elimination Period | Nothing |

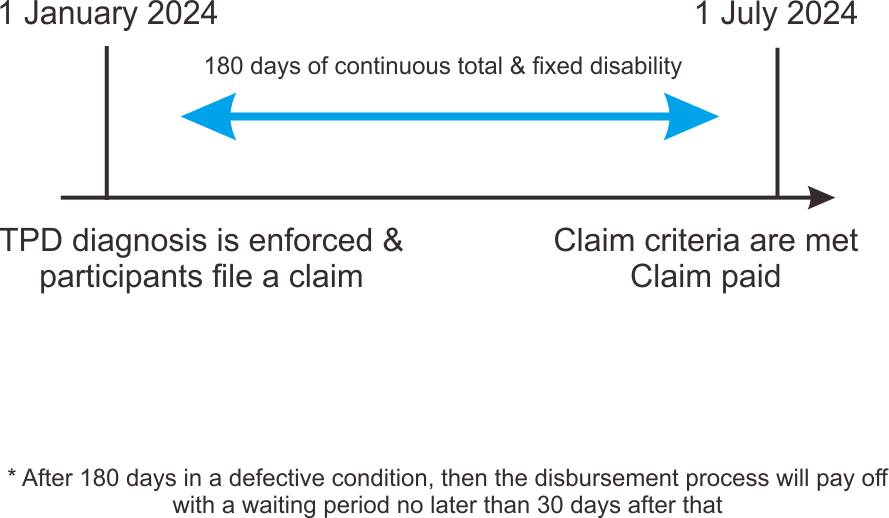

| Underwriting Review Period | Claim decision after the 180-day waiting period whether the condition of total & permanent disability has been met / proved |

| PART OF BODY | % LI | PART OF BODY | % LI |

|---|---|---|---|

| The right arm starts from the shoulder | 70% | The index finger of the right hand | 15% |

| Left arm starting from shoulder | 50% | The index finger of the left hand | 10% |

| The right arm starts from the elbow | 60% | Middle finger or right ring finger | 6% |

| Left arm starting from elbow | 50% | Middle finger or left ring finger | 5% |

| Right hand starting from the wrist | 60% | The little finger of the right hand | 10% |

| Left hand starting from the wrist | 50% | The little finger of the left hand | 7% |

| One-eyed vision | 50% | Four fingers of the right hand | 40% |

| Hearing of both ears | 50% | Four fingers of the left hand | 40% |

| One ear hearing | 15% | Four fingers & thumb of right hand | 60% |

| One foot starts from the wrist | 50% | Four fingers & thumb of right hand | 50% |

| Thumb of right hand | 25% | All toes from one foot | 10% |

| The thumb of the left hand | 20% | Thumb toe | 4% |

| For the left-handed, then the right means the left, for defects in some ngers can be paid proportionally according to the number of loss or defects | Every toe | 1% | |

1. A claim form for a disability that has been completed in full and correctly by the Policy holder.

2. A disability claim form filled out by the attending physician stating that the Insured suffers from a Total Permanent Disability or Partial Permanent Disability.

3. The results of a medical examination that supports the description or diagnosis of the Doctor who treats that the Insured suffers from a Total Permanent Disability or Partial Permanent Disability.

4. Copy of valid self-identity of the Insured and the Policy holder.

5. Account number notification form that has been filled in completely and correctly by the Policy holder, and a copy of the Policy holder’s account book.

6. Power of attorney form for release of medical information and data filled in and signed on the seal by the Insured.

7. A certificate from the Police in terms of the cause of the accident.

8. Other documents (if required).

9. Other documents required in the terms of the Policy.

Hospital & Surgical Care Plus

1. Entry age : 1 month - 70 years old.

2. Age of coverage : until reaching the age of 80 years old

3. Currency : Rupiah (IDR).

4. Appropriation : can only be used for INPATIENT.

5. Claim Process: cashless (domestic) & reimbursement (overseas).

6. Pre-existing conditions cannot be protected.

7. The waiting period is valid for 30 days, except for accidents.

8. The waiting period is valid for 12 months for special diseases*.

* List of 12 Special Diseases :

- Stones in the Kidneys, Ducts/Bladder, Ducts/Gallbladder

- Heart Disease, Heart Blood Vessels and Brain Blood Vessels (example: Coronary Heart Disease, Stroke)

- Hypertension, Hyperlipidemia (example: Hypercholesterol, Hypertriglycerides

- Cataract

- All kinds of cysts, polyps, tumors, cancers

- Diseases related to the ears, nose, and throat that require and have been surgically performed

- Diabetus Mellitus

- Tuberculosis and all the complications

- Thyroid Gland Disorder

- Chronic Kidney Failure

- All kinds of Hernia (example : hernia nucleus pulposus, hernia inguinalis) and Hemorrhoids

- All kinds of Hematology disorders (example : anemia, leukimia, thalassemia)

1 USD = 15.500 IDR (assumption). This number changes according to the exchange rate between IDR and USD when the claim occurs.

1. Valid ONLY for Inpatient

2. Participants pay the total medical expenses themselves at the hospital

3. The original receipt (invoice) MUST be sent to the office a maximum of 30 days after the hospitalization date by sending it first in the form of a new photo then the original document is sent (if there must be other additional documents, a copy can also be attached)

4. When the complete document has been received by Allianz and has been approved, it will proceed to the disbursement process according to the selected Plan and then sent directly to the participant's account

1. Allianz health insurance claim form that is completed and signed by the participants and the treating doctor is complete with a clear name and doctor's stamp along with the practice permit number

2. Medical Resume

3. Original receipt with hospital stamp or logo (complete with address and phone number)

4. Cost details along with a copy of the prescription

5. Medical supporting documents

Note :

1. All documents request to the Hospital in English

2. Point explanation (5): if a diagnostic examination is carried out such as X-rays, ultrasound, CT Scan, laboratory examination, then the results must be sent

Allianz health insurance claim form (1), must be filled out by the doctor and participant

Policy Filing Requirements & Lead TimePolicy Filing Requirements & Lead Time

1. ID Card

2. Postal Code (ID Card)

3. Mobile Phone (active)

4. Email (active)

5. Workplace Address - Postal Code

6. Home Page Photo of Insured Bank Account

7. Heirs Data (ID Card & Home Page Photo of Heirs Account)

8. Height and Weight

9. Supporting Medical Test Data + Right Handed / Left Handed

* The process of applying for Insurance until the status of Policy INFORCE (active) takes a minimum of 1 - 2 weeks depending on the day of the application and the special conditions of each participant.

APPLY NOW !!!

I'm Ready To Serve You Anytime.

Thank You.

Address

Tegal,

Central Java, Indonesian